they tried to shut us down

they couldn’t.

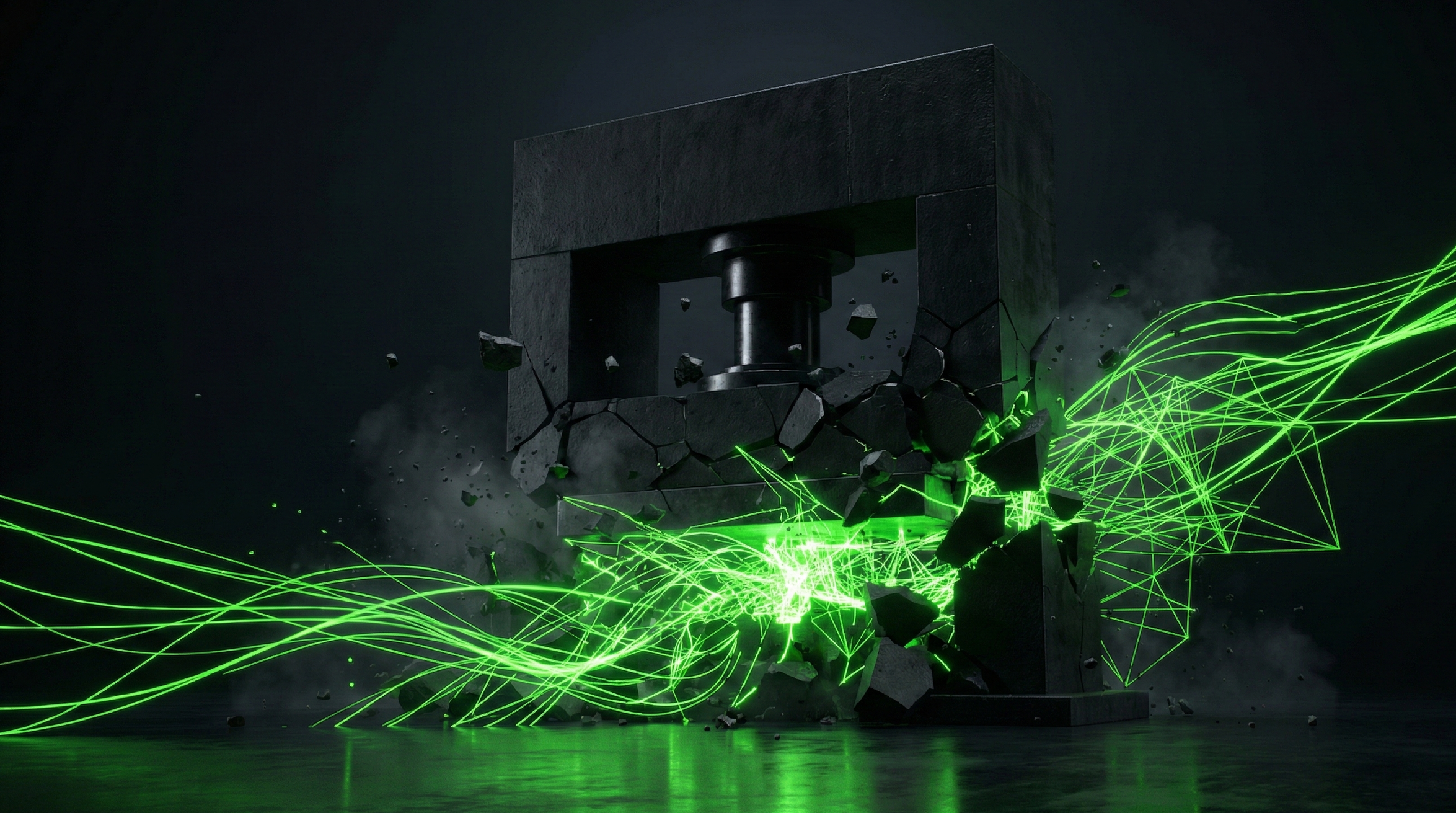

in 2018, india’s central bank tried to erase every bitcoin business. banking ban. blanket order. disappear or fight. we fought. two years in the Supreme Court of India. nearly lost everything. won anyway. the ban was ruled unconstitutional. banking came back. Unocoin survived. but surviving wasn’t the lesson.

we started unocoin in 2013 to bring bitcoin to billions. first platform in india. 2.5 million users. payments, remittances, merchants, infrastructure. we followed the rules. built the product. served the users. they shut us down anyway. not because we broke laws. because we threatened control. that’s when it clicked: if your system can be shut down, it eventually will be.

centralized exchanges look strong—until they aren’t. banks, licenses, regulators. one pressure point is enough.that’s not resilience. that’s fragility. bitcoin was designed to be unstoppable. but access to bitcoin isn’t. to buy bitcoin, you need exchanges. exchanges need banks. banks need permission.

the real question isn’t whether exchanges will be targeted. it’s whether bitcoin access can exist without them. unstoppable money needs unstoppable infrastructure. not robust. not compliant. unstoppable. no bank account to freeze. no server to seize. no ceo to arrest. just code. just protocol. just network. we’re not there yet. but after two years fighting for survival, one thing is clear:

the future isn’t better centralized exchanges. it’s infrastructure that makes them unnecessary. they tried to shut us down once. the court said no. but courts change. laws change. governments change. code only changes by consensus. bitcoin figured that out in 2009. everything built on top of it is still catching up.