what if the benchmark changed??

every fund manager has a hurdle rate.... the minimum return that makes an investment worth their time. for decades it was treasury yields. safe, boring, made sense. you measure everything against the "risk-free" rate and decide if the extra risk is worth it.

but im starting to wonder if that whole framework is breaking down.

adam back said somthing at bitcoin 2025 that stuck with me. "bitcoin is effectively the hurdle rate," he said. "its very hard to outperform bitcoin. most people that have invested in things since bitcoin has been around have thought, oh, i should have put that in bitcoin and not in the other thing." and i keep coming back to that. what if every investment decision now comes down to one question.... can this beat bitcoin over the next ten years?

that startup. that rental property. that diversified portfolio everyone keeps pushing. that "safe" 60/40 split your advisor recommends. can any of it actually outperform just.... holding? back explained why treasury companies are switching to the bitcoin standard. "thats why you get companies switching to the bitcoin standard because its the only way for them to keep up with bitcoin," he said. "they start with a bitcoin capital base. they use the operating in-revenue to buy more bitcoin and then they are able to participate in this kind of micro arbitrage."

less than 1% of companies hold bitcoin. but the ones that do seem to have stopped asking "should we buy" and started asking "can we actually outperform just holding." and for most of them the answer is no. so they stack instead. maybe thats naive. maybe im missing something obvious. maybe bitcoin really is just a speculative bubble and the old benchmarks still apply.

but heres the thing. treasurys dont feel like the safe benchmark anymore. they feel like what you hold when you havent updated your assumptions about whats actually happening. the 10-year yield crashed below 1% in 2008. crashed again during covid. meanwhile bitcoin kept compounding. over any 5-year period in its history, bitcoin has never had negative returns.

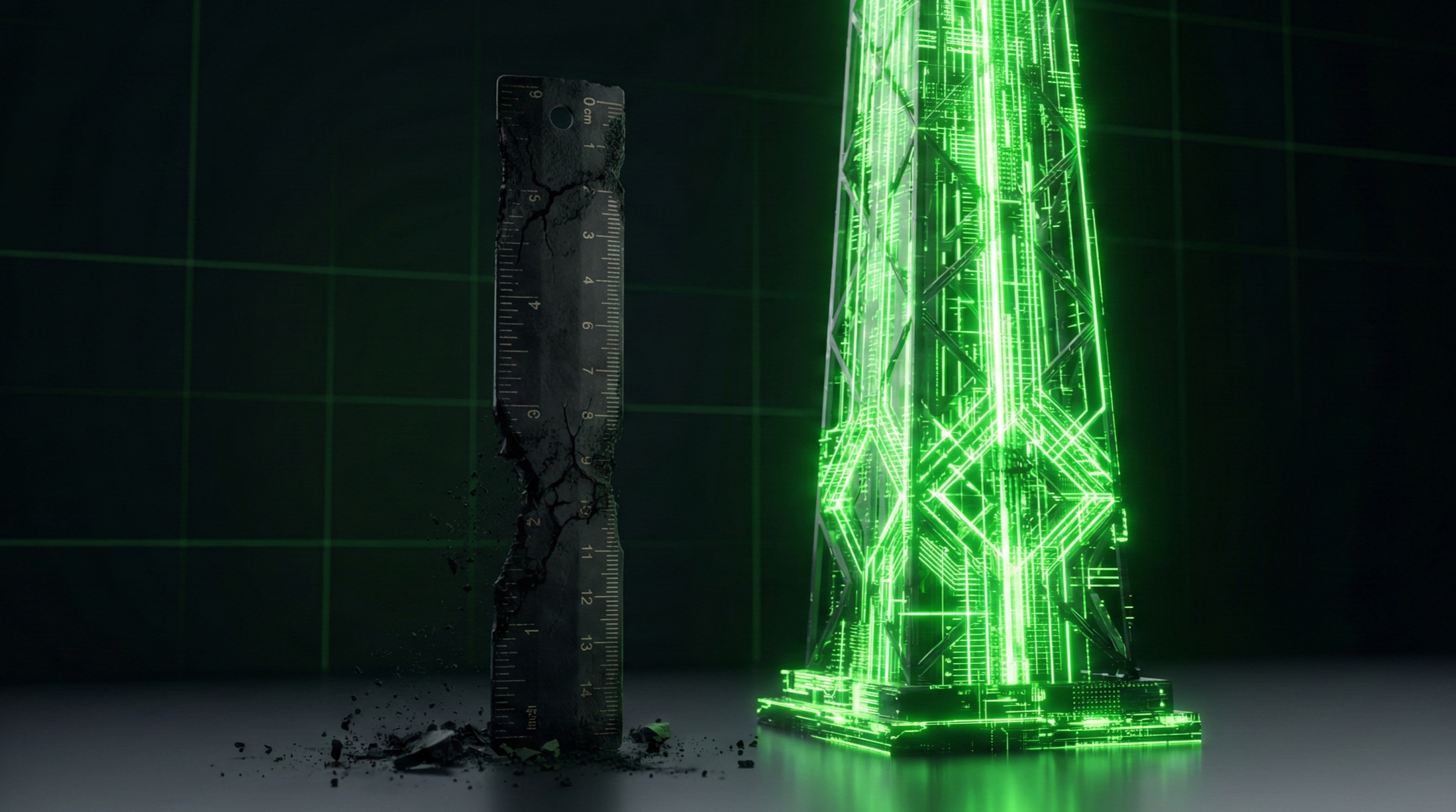

the traditional hurdle rate assumes governments wont debase the currency. it assumes the "risk-free" rate actually exists. it assumes the measuring stick isnt shrinking faster than your returns are growing. what if those assumptions are just.... wrong now?

back also said institutions are still early. only 33% of blackrocks etf is held by institutions. the big money hasnt even fully arrived yet. and when it does, what happens to everything thats been measured against the old benchmark?

is the measuring stick just different now? or are most people still using a ruler that stopped working years ago?